Managing a nonprofit organization requires hard work; it is a mission-driven labor of love that can be deeply rewarding. Every decision you make, every dollar you spend, every proposal you draft, and every report you file connects to your mission. However, when it comes to finances, managing restricted funds, grants, donations, and program expenses can strain your financial team—especially if they are already stretched too thin.

Meet the nonprofit chart of accounts (COA). Think of it as a blueprint for your financial management, helping you stay organized, transparent, and compliant.

In this article, I will re-introduce you to your nonprofit chart of accounts. By the end of this article, you’ll view your COA differently and know how to leverage its functions to set your organization up for success.

What Is A Nonprofit Chart of Accounts, and Why Does It Matter?

A nonprofit chart of accounts houses the general ledger of your accounting system. It’s where every transaction of your organization is filed – organized by categories and account titles. It’s where you keep track of the revenue from a fundraising event, record payroll expenses, or manage grant funds. Your COA is a series of virtual folders containing records of your organization’s assets, liabilities, income, and costs.

For nonprofits, a COA isn’t just about tracking dollars; it’s about demonstrating accountability. Your board members, donors, and even the IRS must see that you’re using funds responsibly and according to your mission. A well-structured COA makes this possible by keeping everything straightforward, accurate, and ready for reporting.

The Format of a Nonprofit Chart of Accounts

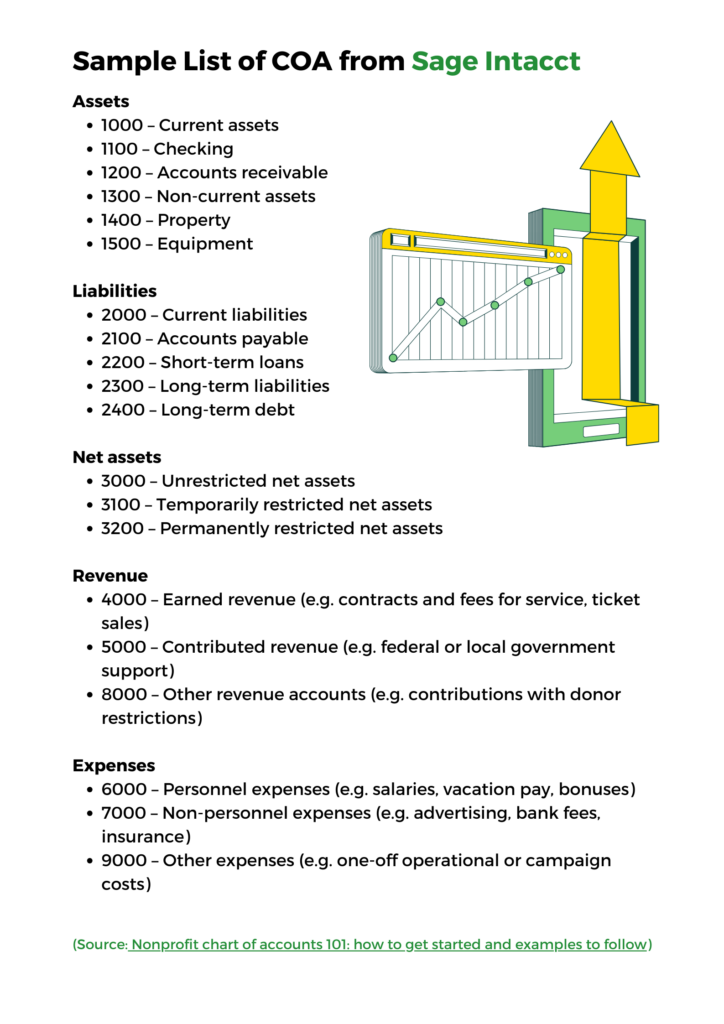

If you’re new to the concept, a nonprofit COA might sound intimidating, but it’s simpler than you think. It’s divided into categories, each serving a specific purpose:

- Assets: What you own—cash, receivables, investments, or property.

- Liabilities: What you owe—unpaid bills, loans, or obligations.

- Net Assets: Funds categorized as unrestricted, temporarily restricted, or permanently restricted.

- Revenue: Where your money comes from—grants, donations, program revenue, or memberships.

- Expenses: Where your money goes—program costs, administrative expenses, and fundraising efforts.

What Records Should You Keep?

The heart of a good COA is accurate record-keeping. Consider the information you need at tax time, during an audit, or when reporting to a major donor. Here’s a sample list of COA from Sage Intacct:

Your COA is your not-so-secret weapon for sustaining your nonprofit organization. Keeping these records organized and up-to-date is a powerful tool for accountability.

Why You Need a Strong Nonprofit Chart of Accounts

For nonprofits, a chart of accounts is more than just an organizational tool; it’s the backbone of responsible financial management. Donors trust you to honor their intentions, whether funding a specific program or building an endowment. Having a strong COA helps you achieve this by organizing these funds into:

- Unrestricted Funds – Unrestricted funds are a nonprofit’s most flexible revenue. They come from grants, investors, operations, and donations where the use of the money has yet to be specified.

- Temporarily Restricted Funds – These are funds received with documentation from the donors specifying their use. These funds usually have a timeline associated with the use of the funds.

- Permanently Restricted Funds – These funds go into an endowment and never expire. Set up an endowment to support a specific activity of the organization.

Organizing your funds in these categories allows you to maintain accurate records of your transactions. If a donor asks for a financial report, you’re always ready to show precisely where the money goes and how it impacts your mission.

A Smarter Approach to Nonprofit Accounting with Sage Intacct

Managing nonprofit finances feels like balancing spinning plates—keeping track of grants, programs, and expenses while ensuring compliance and accuracy. That’s where Sage Intacct steps in. This cloud-based accounting solution simplifies nonprofit financial management, offering a dimensional chart of accounts (COA) tailored to your unique needs.

Here’s how Sage Intacct can make a difference:

- Track Finances by Program, Location, or Grant – Easily monitor and categorize funds based on your organization’s structure.

- Access Real-Time Financial Insights – Generate up-to-the-minute reports to evaluate your financial health.

- Streamline Reporting with Automation – Save time, minimize manual errors, and ensure consistent accuracy.

For example, if your nonprofit relies on multiple grants, Sage Intacct allows you to tag each transaction to a specific grant. When funders request updates, you can quickly produce detailed, accurate reports without hours of manual effort. Think of it as your nonprofit’s financial compass, guiding you toward clarity and efficiency.

Empowering Leaders with Financial Tools

Nonprofit leaders juggle various responsibilities—visionary, fundraiser, advocate, and financial steward. While managing finances may not be the most glamorous part of your role, it’s essential to fulfilling your mission. The good news? You don’t have to handle it all on your own.

Financial management can shift from a stressor to a strength with a well-structured COA and a modern tool like Sage Intacct. These tools free up your time and energy, letting you focus on what matters most—serving your community and advancing your cause.

Partner with JFW Accounting Services

At JFW Accounting Services, we specialize in helping nonprofits achieve financial clarity. Whether you’re establishing a chart of accounts for the first time or optimizing an existing system, we are here to guide you. Our team understands nonprofits’ challenges and knows how to implement solutions like Sage Intacct to streamline your operations.

Let us simplify your financial management so you can focus on making a difference. Together, we can ensure your nonprofit thrives—financially and beyond.

Ready to take the next step? Contact us today to learn how we can support your financial journey.

Jo-Anne Williams Barnes, is a Certified Public Accountant (CPA) and Chartered Global Management Accountant (CGMA) holding a Master’s of Science in Accounting (MSA) and a Master’s in Business Administration (MBA). Additionally, she holds a Bachelor of Science (BS) in Accounting from the University of Baltimore and is a seasoned accounting professional with several years of experience in the field of managing financial records for non-profits, small, medium, and large businesses. Jo-Anne is a certified Sage Intacct Accounting and Implementation Specialist, a certified QuickBooks ProAdvisor, an AICPA Not-for-Profit Certificate II holder, and Standard for Excellence Licensed Consultant. Additionally, Jo-Anne is a member of American Institute of Certified Public Accountant (AICPA), Maryland Association of Certified Public Accountants (MACPA), and Greater Washington Society of Certified Public Accountants (GWSCPA) where she continues to keep abreast on the latest industry trends and changes.