For years, our nonprofit accounting firm has partnered with numerous nonprofit organizations, giving us a real understanding of the unique challenges they face. Our nonprofit accounting experts specialize in preserving your organization’s tax-exempt status, tracking your funding and ensuring you are compliant with ever-changing regulations. Our outsourced accounting services for nonprofits include but are not limited to:

• Risk Assessment Assistance

• Internal Control Recommendations

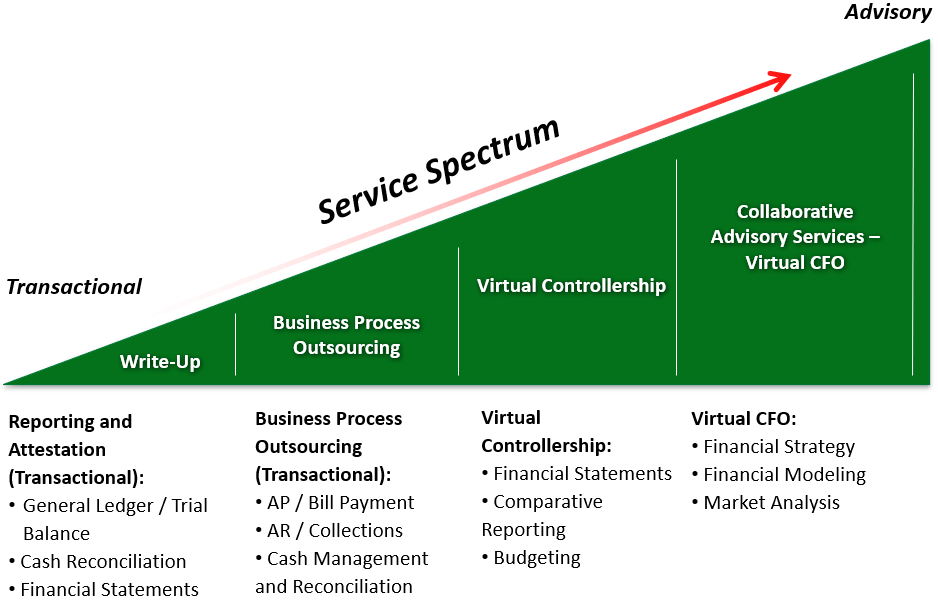

• Virtual CFO Services

• Budget Monitoring

• Reporting to Governance & External Parties

• Strategic Financial Planning

• Bookkeeping

• Recordkeeping & Compliance

• Investment of Excess Funds

An outsourced accounting solution is only as good as the technology it’s built on. JFW Accounting Services utilizes

Sage Intacct Nonprofit Accounting Software, a solution built on a best-in-class, native cloud, highly secure ERP platform.

Real-time data and fully customized reports and dashboards give you instant access to timely, high-value financial information and key operating metrics. Cloud-based budgeting and forecasting tools give you the power to make the best decisions for your business, any time and every time. Tasks like bill pay, expense automation, sales and local tax management, payroll and document management — it’s all inside the only financial management software endorsed by the AICPA.

We relish the opportunity to help you leverage your finances to make the biggest possible impact.