Arts, culture, and humanities organizations make up an important part of society. They include performance arts organizations, historical societies, culture promoters, radio broadcasters, museums, and more. Nonprofit organizations in the arts and humanities categories promote the appreciation of visual, performing, folk, and media arts. They ensure continued appreciation of art history, modern and classical languages, ethics, and how those subjects are shared with the public. These organizations make the world a more interesting and enriching place, literally.

Managing an arts and culture nonprofit requires an elevated skillset and desire to help within their communities, however, the lack of support for nonprofit organizations fueling the arts, culture, and humanities industries has created a need for more professional service providers to join this underserved community. We at JFW Accounting Services have stepped up. We have taken the time to work behind the scenes with some top arts and culture organizations and have fine-tuned our services to better meet their unique business needs.

Maybe the primary concerns at your organization are community involvement and participation; grant proposals, unrelated business income tax (UBIT) liabilities, cash flow shortages, or state compliance issues. Many nonprofit organizations operating in the arts, cultures, and humanities struggle to achieve granular visibility into their organization’s finances or spend unnecessary time trying to classify diverse streams of revenue.

• Real-time bookkeeping and accounting services – cost-effective accounting solutions, powered by Sage Intacct, the only AICPA-endorsed accounting software for nonprofits

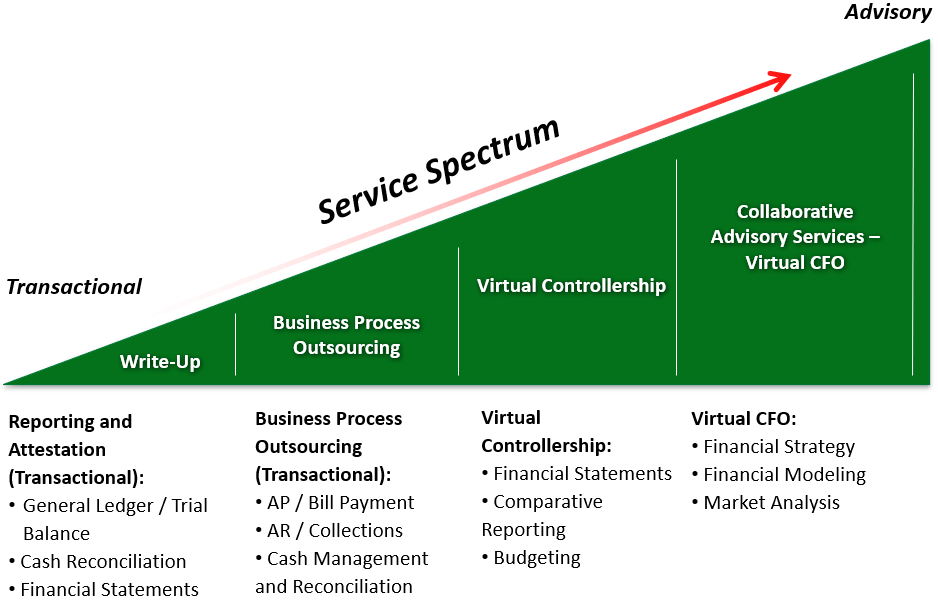

• Virtual controllership and CFO services – to help organizations scale and strategically plan, while meeting the regulatory demands of remaining a tax-exempt organization

• Nonprofit accounting advisory services – designed to improve productivity and efficiency, giving key stakeholders more time to focus on the purpose of the organization

We relish the opportunity to help you leverage your finances to make the biggest possible impact.